I inherited a house years ago and the banks did not keep up with the paperwork. I did not know anything. Thought the house was free and clear according to probate court. Now I try to get a loan and can not. Have not been able to to find anything on who is servicing this old mortgage so I can get it released. 4 companies so far and no ones has it. I am tired of the run around and mortgage companies being able to do what they want and leaving people helpless. They need to be filing proper information like everyone.

Actual Wells Fargo Fake Bank Account Scam Complaints

The scale of the Wells Fargo scam is shocking. An inquiry by an outside consulting company hired by Wells discovered that lower level bank employees opened over 1.5 million deposit accounts that may not have been authorized.

The way it worked was that employees moved funds from customers’ existing accounts into newly-created ones without their knowledge or consent, regulators say. The CFPB described this practice as “widespread.” Customers were being charged for insufficient funds or overdraft fees — because there wasn’t enough money in their original accounts.

Harris & Harris Class Action Lawsuit Over Illegal Cell Phone Calls

A California woman has a potential class action lawsuit in the works against the Chicago debt collection firm Harris and Harris Debt Collectors. She claims that Harris and Harris violated federal law and California law when they called her cell phone in an attempt to collect unpaid traffic ticket dept.

How To Write a Credit Dispute Letter

The Fair Credit Reporting Act or FCRA of 1970 has recently been strengthened in order to allow anyone to dispute negative disputes on their credit report. This can be done with a letter of dispute and in turn the credit bureaus must either delete the listing or verify it. The key to repairing bad credit is to write a properly formatted letter of dispute to one or all of the credit bureaus and send them out via registered mail. Always keep a copy of your correspondence and the receipt from your registered mail letter for further reference. It is also important to make copies of your credit report to include in the letter, not originals. Bel Below is a step-by-step guide to writing a letter of dispute to get rid of those black marks off your credit report for good.

How to Avoid Bad Credit and Repair

Staying in touch with your payments each month can help you avoid bad credit. By keeping yourself organized when your payments are due, you are on your way toward avoiding bad credit. If you do your research on the marketplace before coming to a purchasing decision, you are definitely well on your way to avoiding bad credit and repair credit hassles. You want to consider all applications, including credit cards, student loans, mortgages, and car loans carefully to avoid being overcharged.

Top 7 Tips For Repairing Bad Credit To Purchase Or Refinance A Home

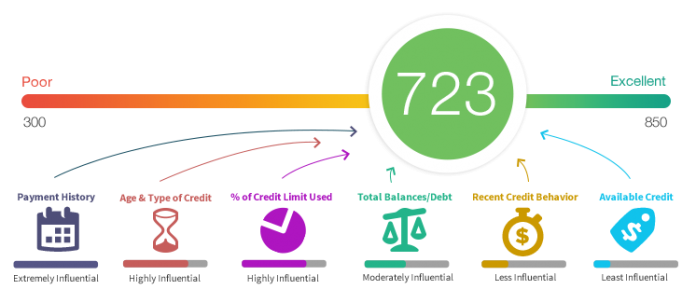

Your credit report and credit score makes huge differences in your life, and in your finances. If you have a great credit score, your home, car, insurance, and more will cost you thousands less because you are deemed “credit worthy.” If you have poor credit, you can be denied a home loan, refinance, and even auto insurance. Yet, most people have absolutely no idea what is necessary to improve their own credit score to accomplish their goals. If you follow these tips, you are sure to see your score improve.

Improve Your Credit Score Before Buying a Home

Several months before you begin to look for a home, you should take steps to get “credit approved” for your loan. Start by making a list of all your existing loans and credit cards, with the company names, account numbers and monthly payment amounts. This will help you to analyze the information shown on your credit report. Include all closed loans and credit cards if these records are available.

How To Build A Solid Credit Rating From Scratch

Building a solid credit rating from scratch is not as difficult as one might think. The reality is that you can establish a decent Credit Score in as little as 3 months and have a solid rating around the 12 month mark. From that point, if you maintain proper borrowing habits, you can have an impeccable rating for the rest of your life.

Three Simple Ways To Use My Credit Repair Tips And Save Thousands!

Before I offer you my credit repair information though, I must tell you that not knowing your current debt situation, this solution may not work for everyone. I’m not a professional credit counsellor or financial advisor, so by saying this, I wish that you take my tips as a stepping stone, however, please make sure you research and get all the facts before attempting any of my ideas.

Overcome Your Bad Credit With These Tips

If you have bad credit, the first thing you will want to do is talk to a credit counselor. Many counselors understand that unforeseen problems like unemployment, medical issues, or other problems often take people by surprise. Lenders are often willing to work with you to setup a payment schedule that can allow you to begin making payments.